The triumphant growth is over

Svetlana Klimova

It seems that the triumphant growth of the new truck market in Russia has ended. If the market indicators of June 2020 were still higher than those of 2020, but by only 1.3%, then already in July the graphs crossed, and the lag was 10% from last year’s value. What is happening, why and when will it level off? These questions concern all players in the automotive market.

What you should pay attention to

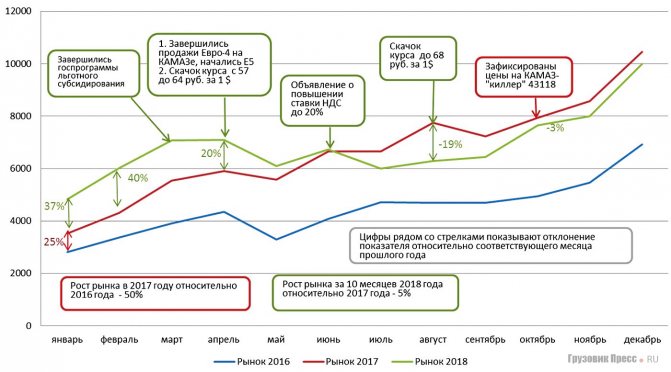

In 2020, the market showed significant growth: relative to the previous year, from 25% in January to 69% in May. In December 2017, compared to December 2020, the dynamics was 51%, and for the year as a whole, the market grew by 50%. This is a very big indicator. For comparison, the average annual growth rate of the truck market in the United States is 34%. In recent years, the Russian market has not been pleased with either stability or serious growth. Therefore, it is difficult to say what indicator is considered normal, but offhand, “normally good” would be dynamics within 20–25%, taking into account the updating of technology and a stable economic situation, and perhaps even less – 15–20%. This means that the figures for 2020 exceeded the “normal” ones by at least 2 times.

In 2020, the situation is somewhat different. Until April, growth continued with excellent figures of +30%, then it slowed down and from July began to lag behind last year’s figures. In August, the market dropped by 19%. As a result, relative to the same period last year, over 10 months the market grew by only 5%.

The diagram shows the events that had a direct impact on the market (it seems that the greatest).

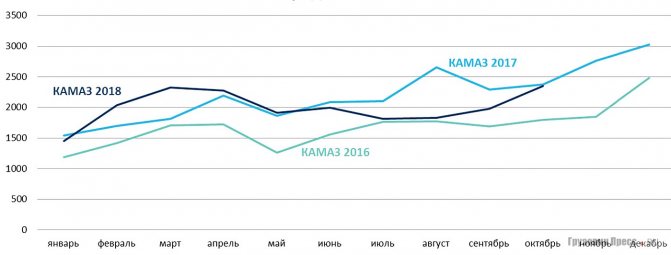

The dynamics of sales volumes of new KAMAZ trucks has been positive since mid-2020. In December 2020, KAMAZ sold a record 3,000 trucks and planned to continue growing. However, a not very noticeable change occurred already in April, the curve turned down, but the situation did not look dangerous. The trend continued in May, but was also not too stressful - May traditionally shows a decline due to long holidays. The situation began to seem alarming in July. The lag not only from ambitious targets, but also from the results of 2020 has become too serious.

We can offer two hypotheses regarding the market in general and one regarding KAMAZ.

What awaits the Russian commercial vehicle market

As part of the business program of the Comtrans 2020 exhibition, the automotive marketing agency Russian Automotive Market Research and the analytical agency Autostat presented their forecasts for the development of the Russian commercial vehicle market.

The Comtrans exhibition today is not so much a review of the visible achievements of truck manufacturers as a forecast of the prospects for their survival in our country.

Sanctions, recycling fees, falling oil prices, a decline in our own economy, the general political situation in the world - there are a whole lot of accompanying factors affecting the production and sale of trucks in Russia. That is why analysts do not see much sense in long-term forecasts, expressing cautious estimates for the next three to five years. Two respected institutes shared their research in this area. The head of Russian Automotive Market Research, Tatyana Arabadzhi, prefaced her speech, noting that her forecast was based on global trends, which, like in a mirror, were reflected in our country. First, about the current situation with trucks in Russia. It is such that today for every one new truck sold there are six used ones. The traditional market leader is KAMAZ. During the period under review, January-August 2020, 17.93 thousand new trucks were sold, which is 7.9% more than last year. However, against the background of growing sales of trucks of domestic brands, there is a drop in demand for equipment of European brands. This is especially noticeable in the Big Seven. From January to August of this year, the VolvoTrucks brand in Russia sank by 13.5% compared to 2020. Mercedes-Benz fared slightly worse - 19.6%. Scania is slightly better - 15.3%. But there are generally sad results: DAF, with its 1,235 trucks sold, has fallen by as much as 26.7% in sales, if we compare its current successes with last year. Let me remind you that in better times, in 2013, for every new truck sold in Russia there were only three used ones. But now we have an increased demand for imported chassis - more and more dump trucks, municipal equipment and other specialized superstructures of domestic production are based on imported bases. According to Ms. Arabadji, Volvo and Mercedes have especially succeeded in this matter.

Now about the survival rate of new trucks in Russian regions. The Moscow region holds first place. During January-August of this year, almost 4.5 thousand trucks were purchased here. The result today is solid, but last year the region that surrounded Moscow was even more generous in purchases - 5.3 thousand cars. The capital is in second place with a result of 4.1 thousand trucks - thanks to renovation and the endless series “expansion of the Moscow road network in order to increase capacity, etc.” Third place goes to the northerners, Khanty-Mansiysk Autonomous Okrug. 2.38 thousand units of equipment were purchased there. Then follow the Volga region, the Urals and Siberia, ending in the Tyumen region, where from January to August the cargo “livestock” increased by 720 new trucks.

But where the situation is more or less stable is in the bus camp. During the above period, the market for new cars for passenger transportation grew by 7%! Our brands are at the forefront. Pavlovsk Bus Plant has sold more than 5 thousand units of equipment over the past 8 months, the sales dynamics is 16% compared to last year. The second and third places are also Russian - LiAZ and NefAZ. Foreigners are only in 4th place, this is the Chinese Yutong. Although the brand shows minus 12.2% compared to the reporting period last year, it is pursuing an aggressive marketing policy. (Yutong literally filled this exhibition with its models in different classes, one of which even elevated it to the category of a world premiere.)

Based on the results of her review, the head of Russian Automotive Market Research predicted three scenarios for the development of events by 2024: optimistic, basic and pessimistic. The range from bad (52.16 units) to good (63.51 units) is small, just over 11 thousand trucks, which suggests very cautious optimism in increasing production. Let us recall that in 2013, almost 80 thousand units of trucks of all brands were produced in Russia.

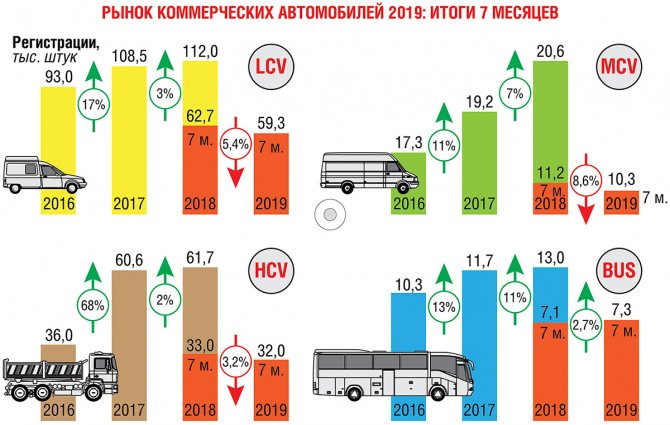

“Autostat” in its research “looked” into the future only until 2021. Viktor Pushkarev, deputy head of the analytics department, also started with the current situation. The commercial vehicle market is in the red in all segments: light duty vehicles (LCV) - 1.3%, medium duty vehicles (MCV) - 5% and heavy duty trucks - 0.5% down compared to last year. Autostat analysts associate future improvements in increasing the production of light commercial vehicles and trucks only with the strengthening of the role of the state, citing as an example the still few assistance programs and other subsidies for purchases. Although it was clearly read outside the brackets that, according to Autostat, in the near future the main buyer will be the state, and not private business. He is not a fighter due to general economic instability, and as a result - a decrease in demand. And where does the growth of the LCV market in our country come from if, according to statistics in Russia, the annual number of small businesses is steadily declining? The average age of a vehicle among heavy trucks in our country is 20.6 years with a tendency to increase. Add to this the ever-increasing price of automobile fuel, and it turns out that the current business is not ready to buy new trucks in principle. Analysts estimate that from 2014 to 2020, the decline in the share of potential new car buyers among MCVs and HCVs decreased by 24%. In the bus market this figure is even worse. Over the past decade, from 2008 to 2020, the share of potential buyers has decreased by 54%! The Avtostat specialist also divided the forecast for all cargo segments into three: optimistic, average and bad. If all goes well, by 2022, 123 thousand light commercial vans will be produced. If we are hit by a low oil price, plus the dollar and other sanctions, then we will only get 106 thousand cars. For medium-tonnage trucks the situation is as follows: excellent - 22 thousand units, bad - 18.5 thousand. Heavy trucks by 2021: optimistic forecast - 66 thousand, pessimistic - 58 thousand units.

The situation with analytical agencies is almost the same - the brightest prospects do not go beyond the level of 66 thousand trucks annually. The conclusions of the analytical accounting department, by the way, completely coincided with the exhibits presented at the current exhibition. By and large, there was only one new product - the GAZelle NN, which, by the way, will enter the series just in time for 2020–2021. All other manufacturers showed cars that had already been exposed to specialists in one way or another at other exhibitions and press shows. What's new? I would like to sell what is currently on the assembly line. (Read a detailed report on the exhibition in this issue.) In this regard, the reports and forecasts were reminiscent of a well-known Soviet joke: a pessimist is a well-informed optimist. But we hope, of course, for an optimistic scenario.

News Media2

Discussion is closed.

I want to receive the most interesting articles

First hypothesis regarding market growth

Deferred demand in 2020 was satisfied ahead of schedule, which was stimulated by purchases related to the development of the budget allocated for the implementation of large government projects.

A hypothesis follows from two facts and one assumption.

1. In 2020, pent-up demand began to be realized, so the market grew very quickly and, as a result, grew 1.5 times compared to 2016. The market dynamics were significantly different from those in 2016, when the market grew by 4% relative to the previous year, so the beginning of the realization of pent-up demand in 2020 can be considered a fact.

2. In 2020, the implementation of major government projects (Crimean Bridge, construction for the World Cup...) was completed - a fact.

3. Toward completion, perhaps budgets were used and equipment was purchased for future use - an assumption.

At the end of 2020, almost 1.8 million commercial vehicles were registered in Russia. During the years of crisis, the commercial vehicle market has shrunk by almost half. During this period, domestic models became leaders in sales in the world. What created favorable conditions for the development of the commercial vehicle market in Russia, said the owner of the AutoVse automobile agency, Alexey Kulkov.

“New high-quality domestic products have appeared. for example, Kamaz, which is partially assembled from foreign components. It has high performance indicators, in particular in terms of efficiency and environmental friendliness. In the model structure, the leadership belongs to Gazelle Next, whose market volume amounted to 14 thousand product units, an increase of 24% in 2020. According to manufacturers' forecasts, in 2020, about 40 thousand Gazelle Next will be produced with components from Volkswagen and a German diesel engine. The most popular foreign car based on sales results for the first five months of 2018 was the Volvo FH model, the best truck for long-haul transportation. Sales of this brand increased by 58%. 1,860 cars were produced. The second place is occupied by the Mercedes-Benz Actros - 1,420 vehicles produced and sales growth by 13%. Bronze went to DAF XF-Series - 1164 units of equipment and an increase of 20%. At the forefront of demand for a particular model is how functional and convenient it is for the client. Environmental friendliness and safety are secondary criteria. And, of course, the body design - where would we be without it? We also must not forget that there is a concept of the price attractiveness of a car. When choosing a car, the buyer is guided by the following criteria: personal beliefs, needs and their relationship with income level, as well as the ability to purchase a car for cash or on credit.

A study conducted by the Autostat agency noted that sales in the primary market of commercial vehicles increased by 50% in 2020, that is, more than 80 thousand units were sold. The volume of the used car market did not change compared to 2020; in total, about 280 thousand cars were sold. The Chinese brand Foton has grown 10 times in a year. KamAZ occupies a leading position in both the used and new truck market. The most popular models were KamAZ-43118, Mercedes-Benz Actros and Gazon Next. Sanctions and the collapse of the ruble affected the economic situation in Russia. New cars have become more expensive, and the standard of living of most Russians is lower. Many people put off buying a car, and as a result, pent-up demand formed in the car market. As the Russian Automobile Dealers Association notes, demand now exceeds 1.5 million cars, while prices have increased by 10-15%. New car models are much more expensive than previous ones. The relative stabilization of the ruble exchange rate and the economic situation motivates Russians to make a purchase in 2020, without delaying it until later. This is also evidenced by the results of a survey conducted by Autostat. Last year, passenger cars were sold for more than 2.3 trillion. Rubles, which is 20% higher than before.

It is difficult to say what will happen to the commercial vehicle market; one can only assume: the country’s economy has stabilized. There are signs of growth in certain industries. According to the Autostat agency, in 2020 the cost of cars will continue to rise, mainly due to inflation and an increase in VAT to 20%. At the end of 2019, prices will increase by 6-8%. Prices will be formed under the influence of the economic situation in Russia and companies' strategies to maintain market shares. The Russian Federation has adopted a “Car Recycling Program”, which has been in effect since 2010. Under the terms of this program, car owners who decide to recycle an old truck receive a discount on the purchase of a new model (the discount ranges from 90,000 to 350,000 rubles). Also, under the state business support program, leasing trucks and commercial vehicles are 12.5% cheaper.”

Second hypothesis regarding the fall in demand

The natural pullback after the surge is more likely not a fall, but a return to normal, and this could last until the middle of next year - the advanced demand will be compensated.

If we assume that “normal” growth would be 25%, then recovery will occur by the middle of next year. Under the “normal” growth scenario in 2020, the market would have been around 66,000 (instead of the 80,000 received), and we would have arrived in December 2020 at the now expected 83,000, instead of the 102,000 trucks predicted by PwC in the first half of the year. I would like to think that since everything turned out this way (the planned 83,000 took place in December), then a new life will begin in January, but this is unlikely. There will be accumulated negative factors associated with unfulfilled expectations of automakers and general instability.

The third hypothesis about the KAMAZ sales crisis

Preamble. 2020 is a turning point for KAMAZ - the plan was to sell more than 10,000 new trucks and cross the 40,000 mark in total production. The planned growth for 2020 relative to 2020 was more than 60%. Based on the implementation plans, production also worked. And in November, the company already announced a downtime for three days, there are rumors about serious downtime in December and a shutdown of the conveyor in January 2020. KAMAZ is falling faster than the market and, in all likelihood, will return to last year’s levels.

So, the third hypothesis. KAMAZ overfed the market with “killers” and thereby undermined sales of its own vehicles at normal prices.

The long period of sales of “killers” (more than 6 months) has accustomed consumers to this extremely low price level for KAMAZ. Comparison of prices (“frozen” back in October last year) for “killers” and for updated models is in strong contrast and does not contribute to the consumer’s feeling of a fair price and trust in new cars. A kind of cannibalism: a cheap product segment did not allow the development of a new, much more expensive one.

The future of the aftermarket and automotive retail

The latest trends in the sale of cars and spare parts were discussed in mid-April at the ROAD conference in Moscow. The main task of the experts was to find solutions for the successful development of the auto business in the next decade.

Overseas experience

Traditionally, the United States of America has been a trendsetter in the global automotive industry for several decades in a row. Practice confirms that industry events in the United States sooner or later are reflected in Russia.

Therefore, ROAD President Oleg Moseev began his speech by summarizing the latest trends in the American market in order to predict how we will live and work in the next 5–10 years. His speech was based on materials from the NADA 2019 conference, which took place at the end of January in San Francisco.

Spare parts and service - the basis of business strategies

One of the main problems that American dealers have faced in recent years is falling margins when selling cars. For new cars it is no more than 2.9%, and for used cars – 12.1%. In this situation, the main sources of income for dealerships were car service and the sale of spare parts - these types of businesses bring 48.5% of the profit.

Over the coming decade, the average American dealer will see many changes in how they set up and operate a business, but the fundamental business model will remain the same.

Prices will become uniform

How will the economy change? First of all, there will be an end to bargaining and price wars, and everyone will switch to common price lists. Those automakers and dealers who have already switched to this model demonstrate better efficiency. Service will become an even more important source of profit. In a situation where the margin on the sale of new cars tends to zero, a new approach to the distribution of costs of automakers will be required. Personnel costs will evolve, and with increasing competition due to declining sales, cost control will become even more important.

Direct deliveries and online trading

Offline sales will gradually decline, the number of cars supplied to order will decrease, which will lead to a decrease in inventory, and the share of online sales will grow. Internet trading will almost completely destroy the geographical factor, the advantage of the location of the dealership will be significantly reduced.

One of the features of US auto retail is that direct sales by automakers are legally prohibited in most states, which contributes to the development of dealer business, while in Western European countries, where there are no such restrictions, according to forecasts, in 2025, 15–20% of cars will be sold directly by automakers , without the participation of dealer centers. This trend will not escape our country, what can we say, even if Lada announced sales via the Internet.

Electrification and car sharing

North America currently lags significantly behind Asia and Western Europe in the area of electric mobility. By 2025, only 6% of passenger cars in the US are projected to be electric. For comparison: in the same period their share in China will be 26%, in Western European countries - 15%.

On the other hand, car sharing and ride sharing, which are considered one of the main trends in Western Europe and a number of Asian countries, are already a thing of the past in the United States: according to forecasts, in 2025 the share of such vehicles will not exceed 2.4%. In North America, various types of sharing are being replaced by new sales models, such as “car subscription” or “all-inclusive” services, where the consumer pays in advance for the use of a particular car model or the entire model range of one or even several automakers for a certain time.

In the US, such services are provided both by automakers themselves (for example, the new Volvo XC40 model is initially offered under this scheme) and by operating companies. The main advantages for customers who use the “car subscription” service are the following: access to the latest technologies, the opportunity to drive a new car all the time, and constantly test new models. At the same time, their costs are significantly lower than when buying a car, and there are no problems with selling the car with this scheme.

Reduction of private vehicle fleet

Because subscription vehicles are driven more intensively than personally owned vehicles, the overall demand for vehicles is reduced. According to forecasts, in the future this could lead to a decrease in total passenger car sales by 29%. In the United States, already every year 2% of the car fleet is shifted from personal to corporate. This trend will have a negative impact on independent services. Due to more intensive use, a significant part of the service life of new machines will be exhausted during the warranty period. However, there are also advantages for the auto business: premium segment cars, which have higher margins, are becoming available to a wide range of consumers. For example, 80% of customers who use Mercedes-Benz cars “by subscription” have never owned a car of this brand before.

Now the model of consumer behavior is changing; representatives of the younger generation do not strive to own a car, but are still ready to use it. This trend will intensify in the future. Also, more intensive operation will allow the model range to be updated more often.

Of course, the need for cars will be lower, but they will be replaced much more often. And, importantly, such a business model will put car servicing under the control of automakers and their dealers, which will allow them to generate additional income.

What will happen to the Russian market

Now let’s move from the American market to the world market and see how Russian auto retail looks against this background. Sergei Tselikov, director of the analytical agency Autostat, made a report on this topic as part of the round table on market analytics.

Approximately half of the world markets included in the top 15 showed negative dynamics in 2020, including the largest Chinese market. Only two markets: Russian (+12.8%) and Brazilian (+13.8%) showed significant growth last year. However, this year our market also entered a period of stagnation.

Sales growth is significantly constrained by rising car prices and decreasing government support. The average cost of a car in 2020 increased by 13% and amounted to almost 1.5 million rubles.

In the first quarter of 2020, there was a new round of price growth due to an increase in VAT. Fortunately, the “auto-inflation” of the last four years has completely “recovered” from the depreciation of the ruble against major world currencies, so there is no need to fear further price inflation.

On the other hand, according to Avtostat forecasts, the sales volume of new cars this year will largely depend on the cost of oil and exchange rate fluctuations. If oil costs $70 per barrel, then car sales will increase by 4%, at $60 they will decrease by 3%, and at $50 per barrel the market will fall by 10 percent.

New sales formats

Among the new trends in the spare parts market, the growth of online sales should be noted. Manufacturers and retailers are penetrating each other’s areas of interest, for example, tire shops are opening in shopping centers, chain restaurants are starting to operate in dealership centers and gas stations, which allows improving service, expanding the customer base and increasing sales.

The auto components market will not fall

GFK automotive market research expert Denis Bukhtin provided interesting statistics on some groups of spare parts sold in Russia in 2020. According to him, the automotive components market is doing well so far. This is largely due to the fact that last year the vehicle fleet in Russia reached its maximum and significant growth was observed in most spare parts segments. Thus, the volume of the automotive lighting market grew by 14.6%, transmission oils - by 10.9%, tires - by 9%, batteries - by 8.6%, motor oils - by 2.2%. The upward trend, he said, should continue in the coming years.

This will definitely be facilitated by the accelerated aging of the Russian vehicle fleet. Let us remind you that according to recently published statistics from Autostat, in Russia over 58% of cars are over 10 years old, which is at least 25.4 million vehicles. Agree, the potential of the service and spare parts market looks impressive!